Feb 18, 2020 by Mark Dingley

In January 2020, the World Health Organisation announced that the Coronavirus had become a Public Health Emergency on a global level. At the time of writing, the virus had infected over to 75,000 people around the world.

Within days of the virus reaching the global media, Wuhan, the city at the centre of outbreak, was placed into lockdown. Now, at least 15 other major cities in China have also been quarantined, closing all public gathering places and shutting down factories, directly impacting approximately 50 million people. Travel in and out of these provinces has been brought to a halt.

Internationally, many countries evacuated their citizens out from China, including the UK and Australia. The United States of America has put into place a travel ban against any foreign internationals who have visited china in the 14 days prior to their arrival to USA.

The Chinese economy is worth $14 trillion, making it the second-largest economy in the world. By comparison, Australia is ranked 14th for Gross Domestic Product. The international community – including Australia – relies on China for education, tourism, minerals exports, manufacturing and much more.

In fact, China is Australia’s biggest trade partner and export market. Over 1.5 million Chinese tourists visit every year, whilst the Chinese-student market alone is worth $15 billion. By restricting relations with China, industries such as tourism and mining will be immediately affected.

“You turn off the flow of Chinese tourists for six months and that’s a big economic shock.” Economist and former Reserve Bank board member Warwick McKibben, via The Guardian.

Did you know almost all of the iPhones in the world were made in China? This is just one example of the multitude of international businesses that will be immediately affected as the coronavirus brings the country to a stand-still.

Wuhan itself is home to China’s steel industry, making it a manufacturing hub for a number of leading automotive companies, including Nissan, Honda and GM. Corporate giants such as Walmart, IBM and Siemens were also attracted to the region thanks to the low operating costs when compared with China’s eastern seaboard.

However, in an effort to restrict the spread of the coronavirus, many Chinese regions prohibited businesses from resuming normal operations before February 8. This was to stop the mass migration of workers back to factories following the Chinese Lunar New Year on January 25, 2020.

Many Australian businesses can expect to be impacted in the coming months. If you are a business owner, then the reality is that parts of your supply chain will likely pass through or even take place in Wuhan itself, either for manufacturing, assembly or finishing. This will result in major disruptions for an unknown period of time.

Indeed, if you source parts of materials from anywhere in China, not just from Wuhan, you should expect and prepare for your business to be impacted by shortages and delays.

In 2019, China became the largest export market for Australian beef, accounting for 24.4% of beef exports in the past year. China is also our third-largest market for live cattle exports. Both red meat and live cattle exporters are now bracing for a significant drop in demand.

This is the result of a combination of factors. Firstly, transport restrictions and labour disruptions across China will limit the ability to distribute beef, whilst fears of contracting the virus means Chinese people are avoiding non-essential travel and activities such as dining out.

In 2002, a similar state of panic emerged in China during the SARS outbreak. Whilst less than 10,000 people were infected, tens of millions changes their behaviour out of fear. Businesses that experienced the brunt of the impact were leisure venues, such as restaurants, bars, cinemas and hotels, and those associated with international and domestic tourism.

As a result, even the Australian wine industry is concerned about the potential ramifications of the Coronavirus. Shares in the Treasury Wine Estates, a seller of premium wines into the Chinese market (including iconic estates such as Penfolds Grange), have already dropped by 30+%. This is a reaction by investors to the potential hit that top-end wine sales will likely experience.

The Australian Lobster market has already taken a massive hit. Geraldton Fishermen’s Co-Operative in WA, the world’s largest exporter of rock lobster, put all deliveries on hold for the first time ever in late January.

Unfortunately, Chinese New Year is normally their busiest trading month for the year.

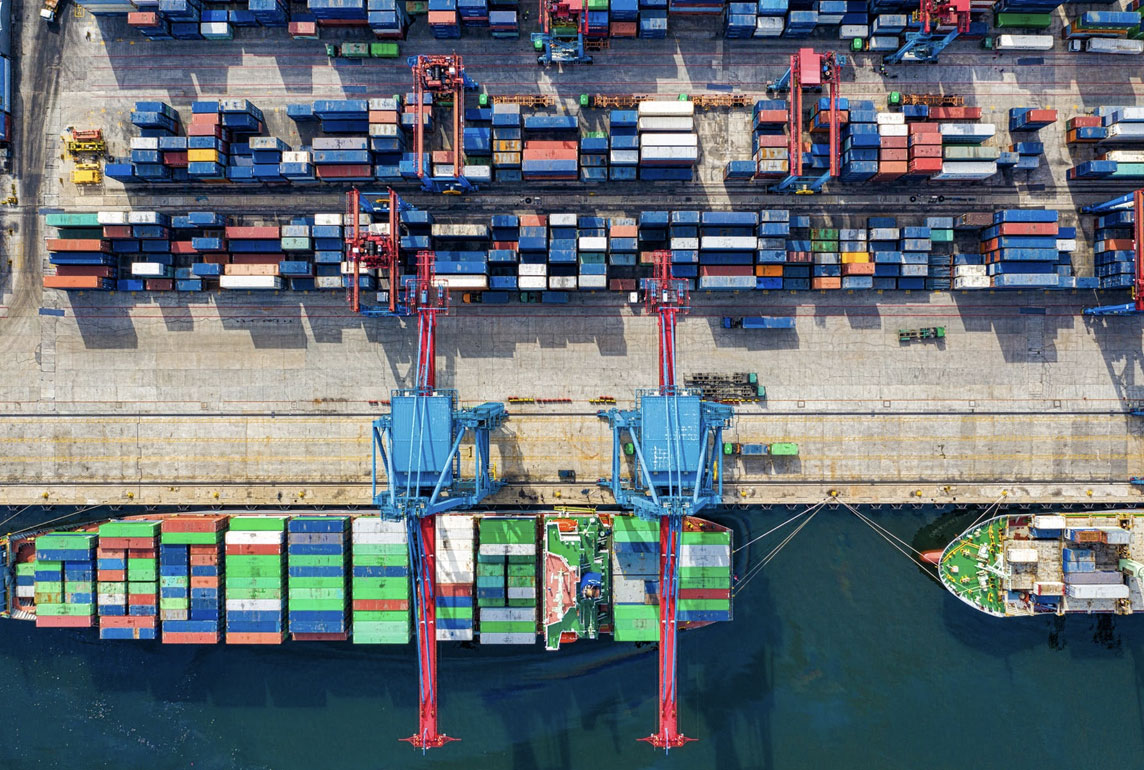

Supply and demand aren’t the only issues that are impacting Australian businesses. Manufacturers and suppliers should also prepare for major disruptions on a global scale.

The coronavirus is already impacting air freight demand and capacity, with airlines cancelling flights and shippers reluctant to fly goods into China. Air-cargo has been suspended to and from China from British Airways, whilst Qantas has suspended all flights between Australia and China.

Flights aren’t the only challenge faced by businesses – customers don’t want to pay for storage in China as transportation can’t be offered on the receiving side. Shipments also can’t be collected at this stage, as truckers, cargo handlers, warehouse and manufacturing staff are unable to return to work.

This is all in addition to the huge backlog caused by the extension to the Chinese New Year holiday (to halt the migration of workers), and businesses can expect increased demand and rates.

The main reason that the coronavirus will impact the Australian supply chain is because people will change their behaviour. This means social activities will likely experience the most disruption, including:

For businesses and organisations indirectly exposed to the Chinese market, it is the ideal time to consider your supply chain and take necessary steps to reduce the potential impact.

If you need to talk to the experts about your supply chain, Matthews can help.